BOCY

Overview

BOCY is a mobile app designed to help people who are just starting their credit journey avoid falling into debt by providing them with clear, engaging tools to understand how credit works, manage their spending, and build healthy financial habits from day one. It targets the gap between gaining credit access and knowing how to use it responsibly, especially for students, immigrants, and young workers aged 18–25.

Understanding the challenge

To build a meaningful and supportive credit experience for first-time users, I needed to deeply understand the core obstacles they face. Research revealed that new users are highly susceptible to misusing credit due to a lack of foundational knowledge. Many were unaware of basic credit principles like utilization, interest, or payment timing. As a result, they experienced unexpected fees, damaged scores, and anxiety around repayment; all within months of accessing credit for the first time. This behavioural gap, not just access, became the central issue to solve.

Research insight

84% of Gen Z respondents had acquired credit access in the past 12 months

68% had never heard of the term "utilisation rate", despite it being a core factor in score calculation.

61% believed missing one payment had little or no impact on their credit score.

70% of international users reported barriers to access due to lack of UK address history or credit files.

This mix of user quotes, behavioural data, and knowledge gaps revealed a major disconnect between access to credit and readiness to manage it. It became clear the solution must combine education, motivation, and trust-building design patterns.

Ideation

With a clear understanding of our users’ needs and challenges, I began ideating ways to frame the credit experience. I explored solutions that would merge behavioral psychology, familiar interaction patterns, and embedded education to make financial habits feel approachable. The ideation phase involved rapid sketching, competitive analysis, user flow mapping, and prototyping key user journeys.

Wireframes

Outcome

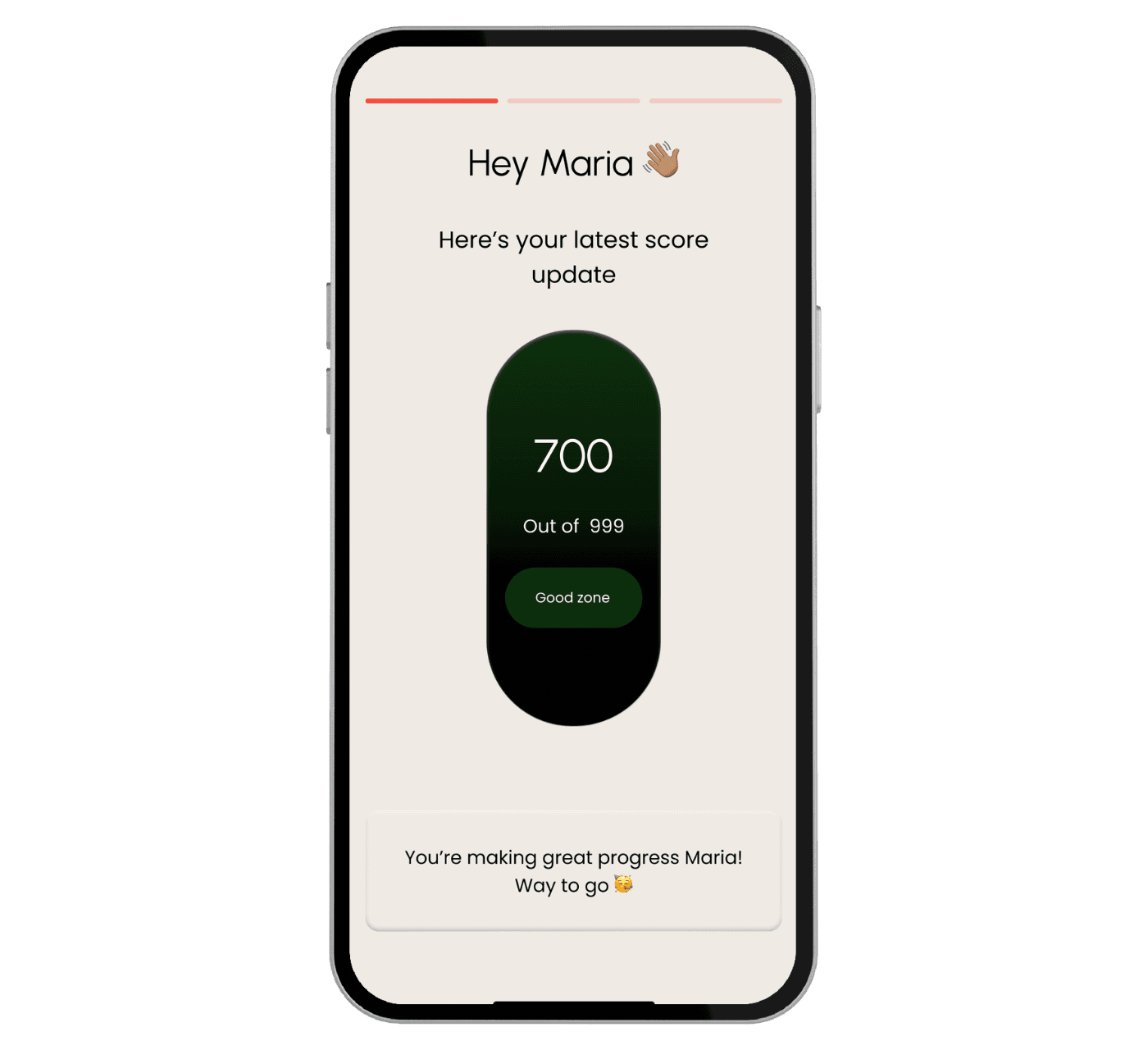

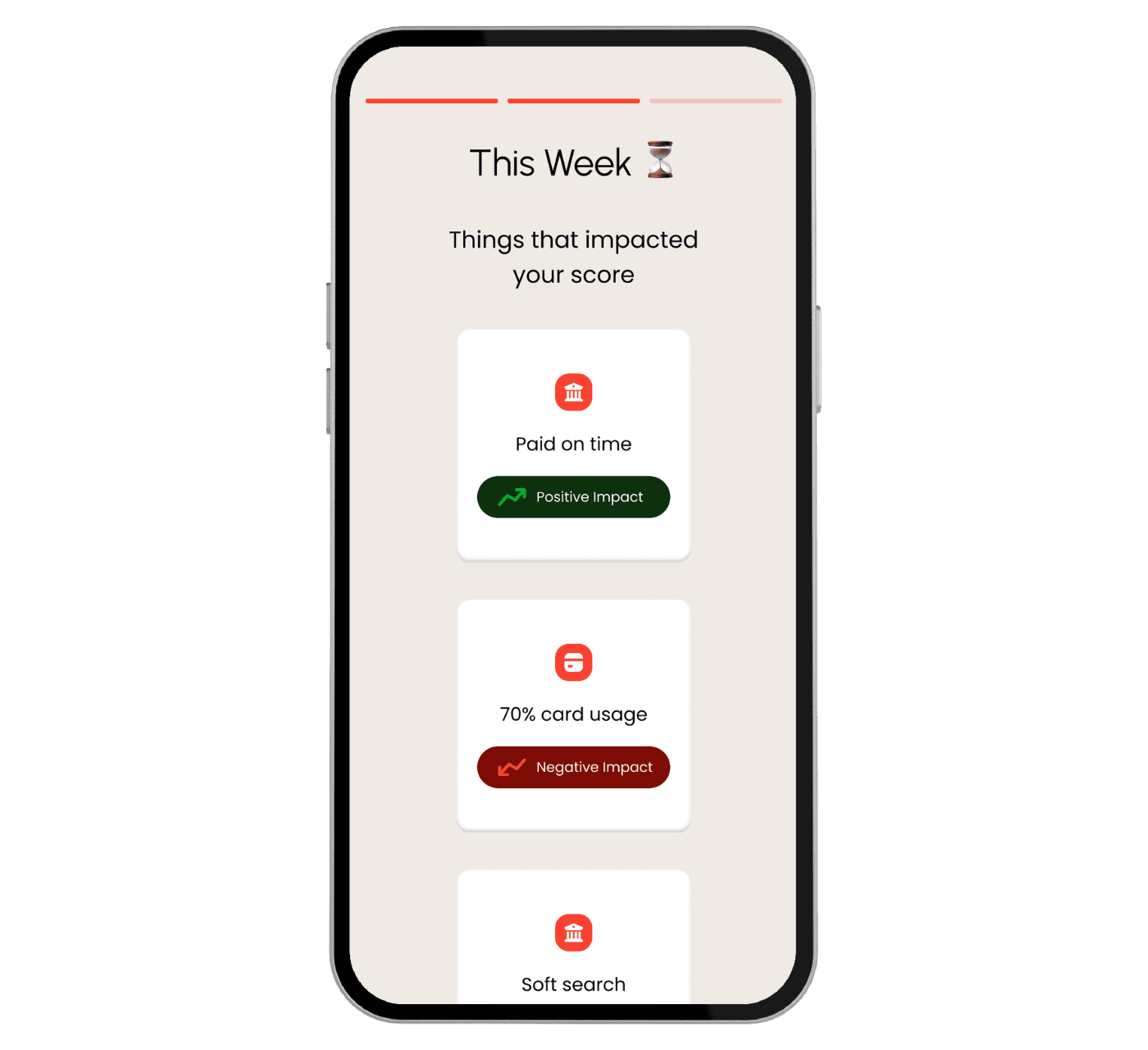

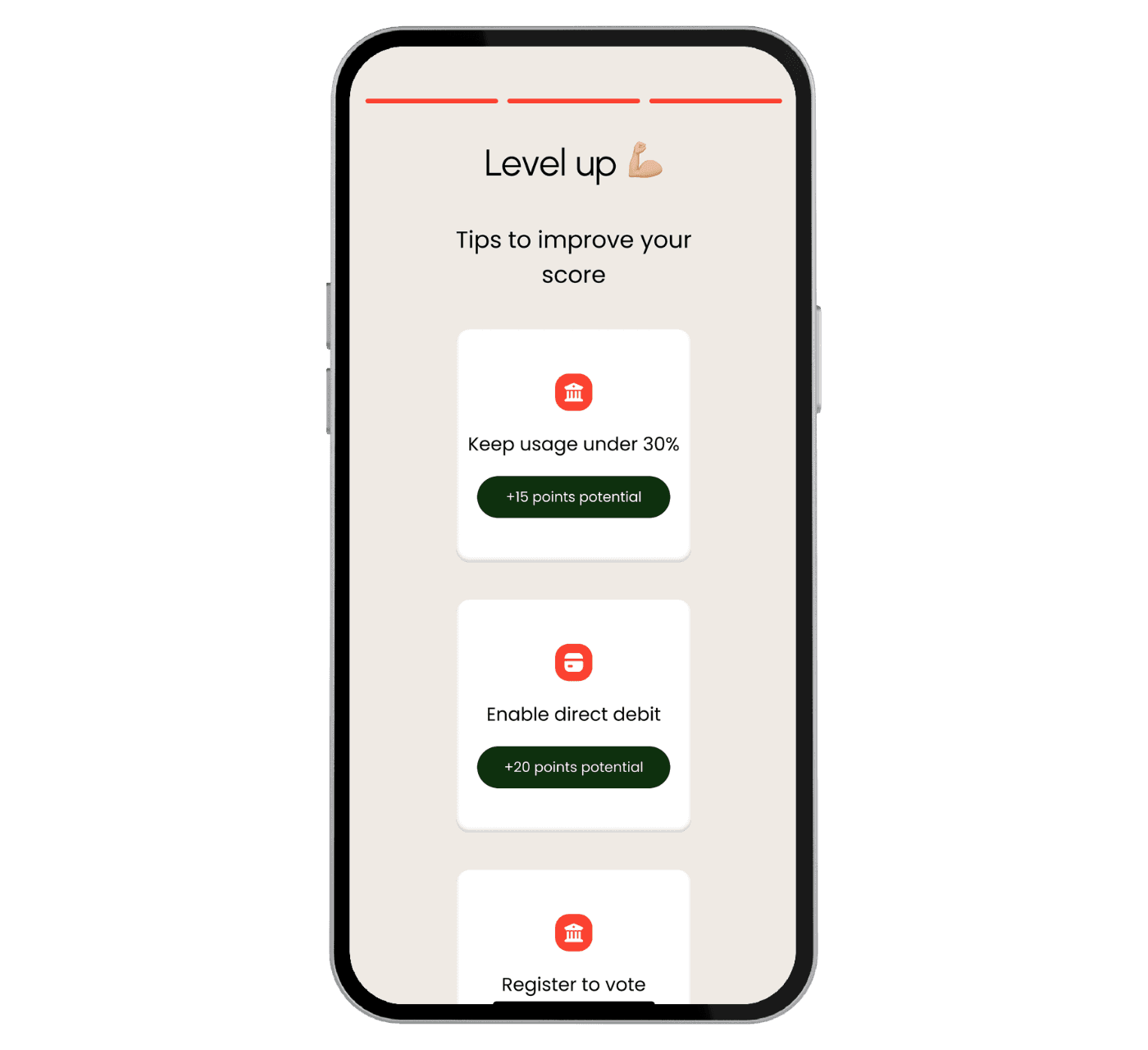

Credit Story

New users begin their journey with a story-style credit overview a familiar format for Gen Z. It breaks down their credit score, recent impacts, and actionable tips into swipeable screens. This format simplifies data into bite-sized, visually engaging updates that feel natural, fast, and frictionless.

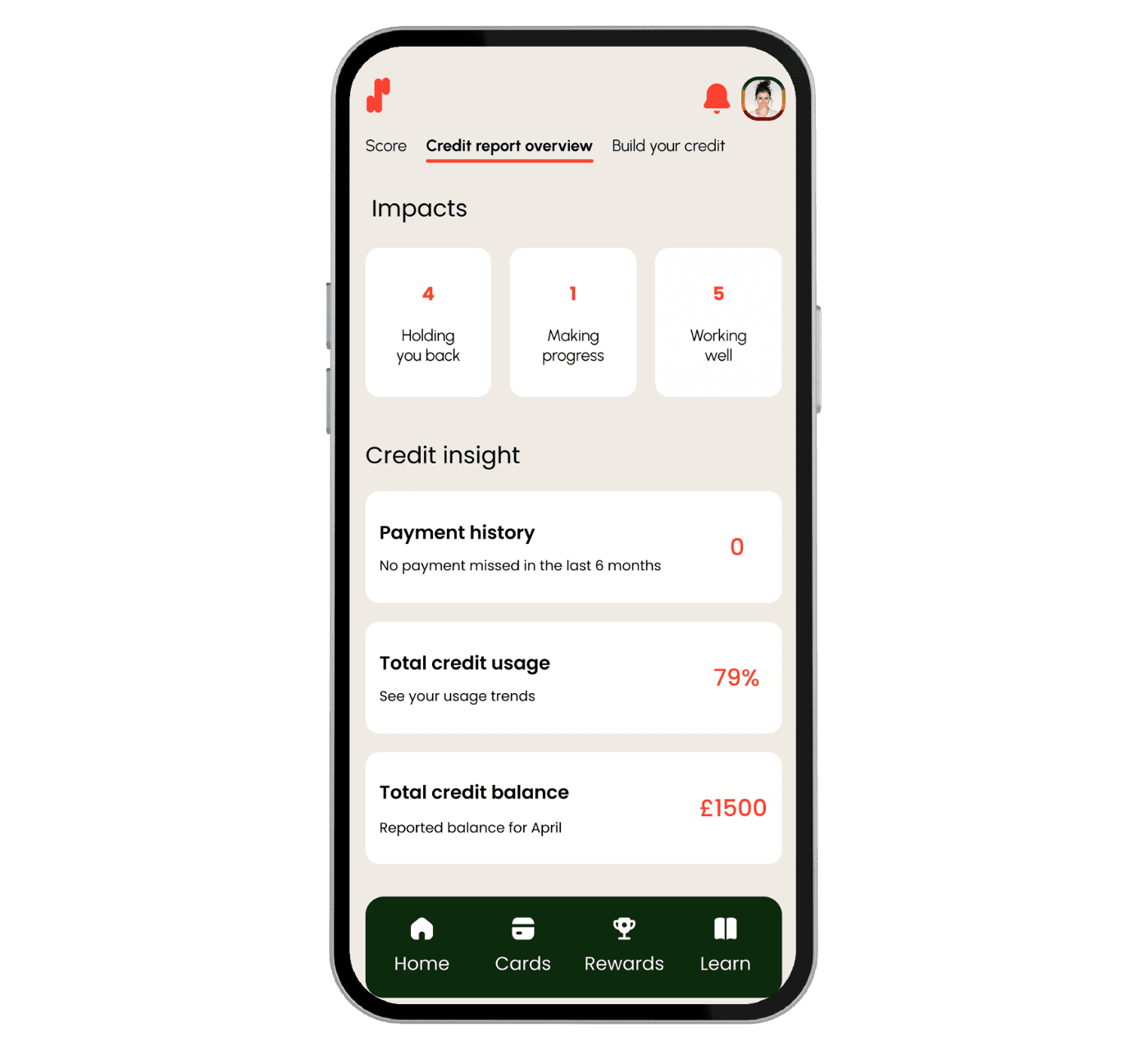

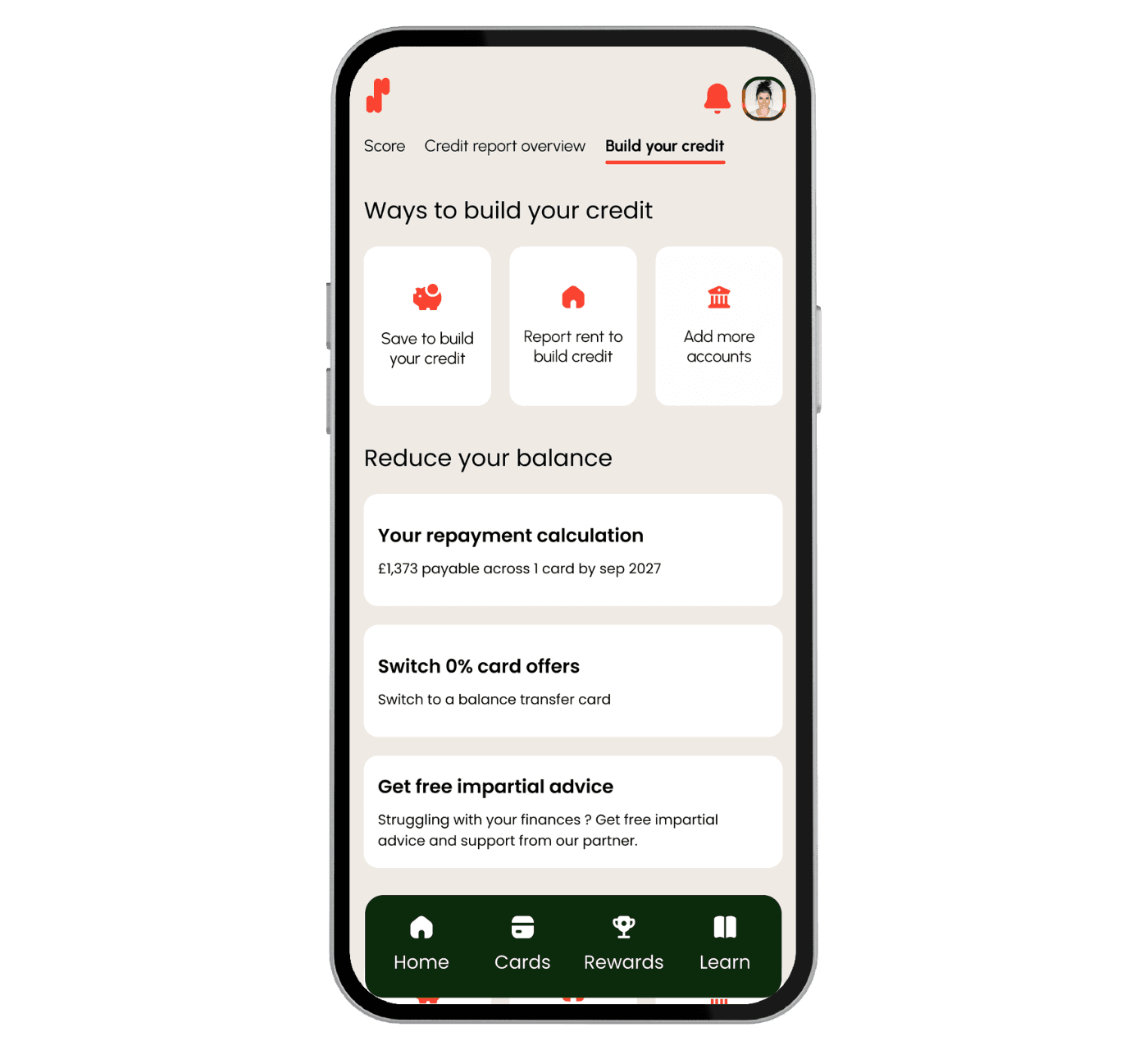

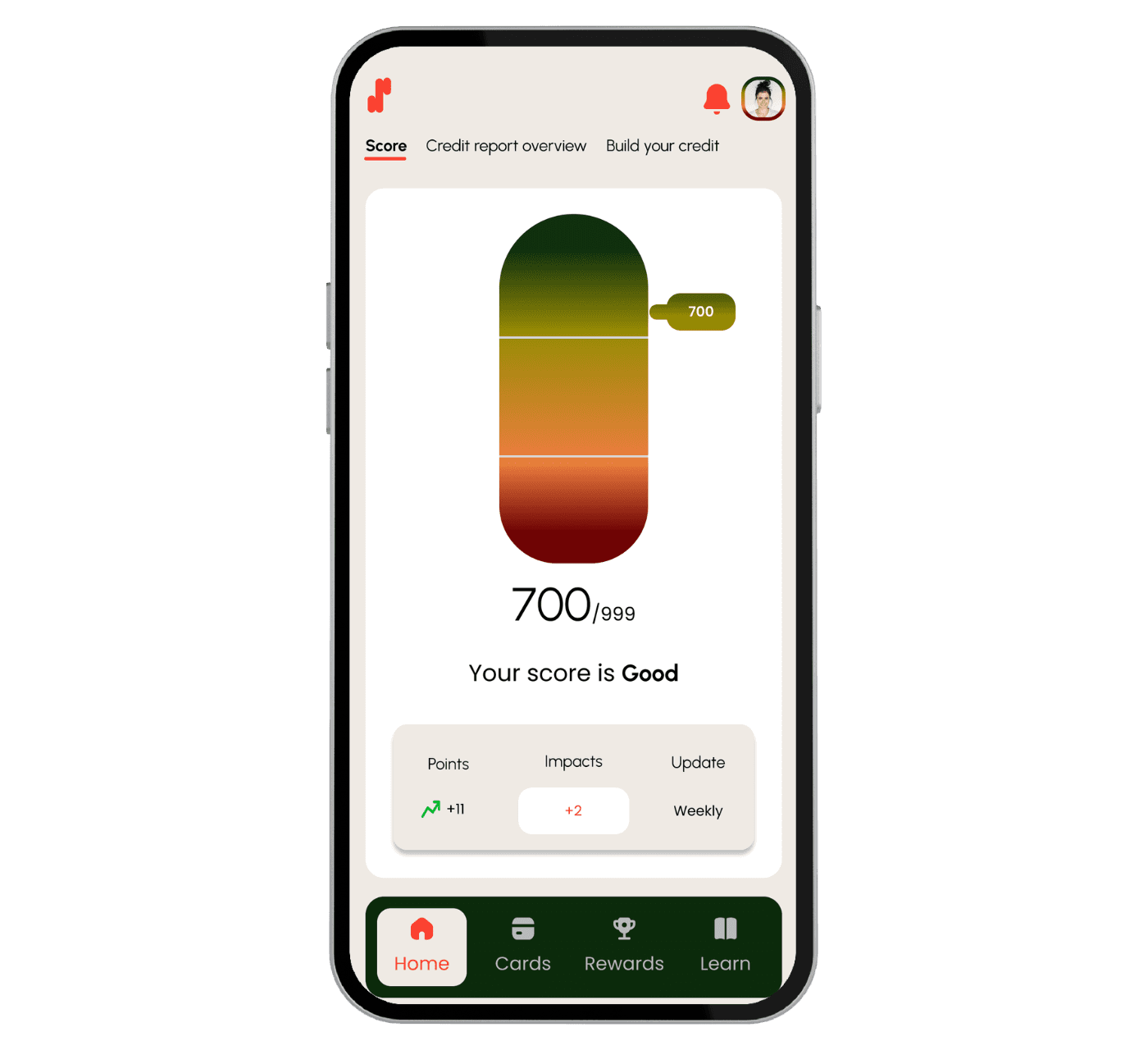

Core Dashboard & Credit Tools

The homepage provides a clear view of the user’s score and the factors affecting it, with tabs for “Credit Report Overview” and “Build Your Credit.” These deeper sections offer score breakdowns and opportunities to take real action, giving users control over their credit narrative with clarity and transparency.

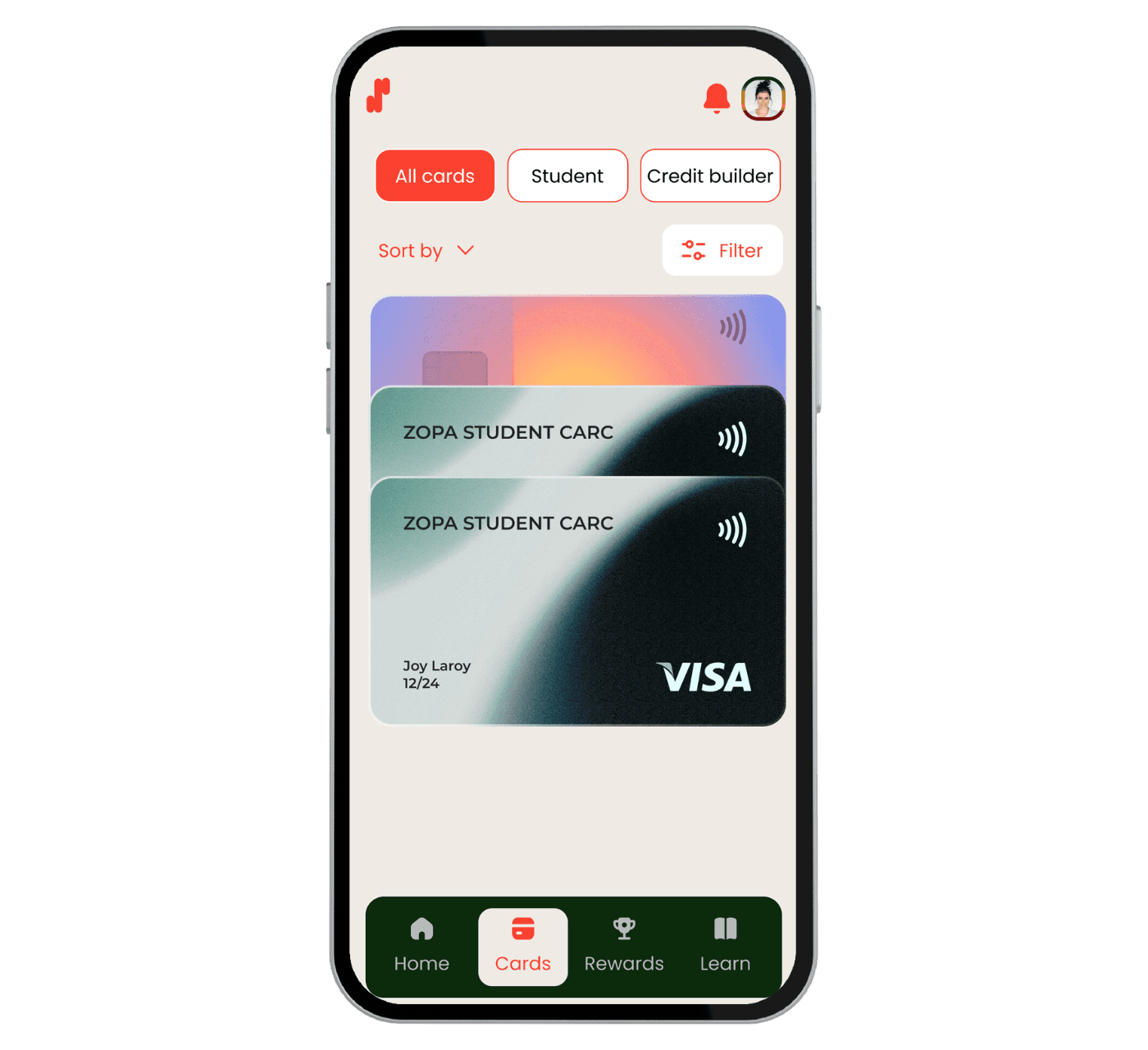

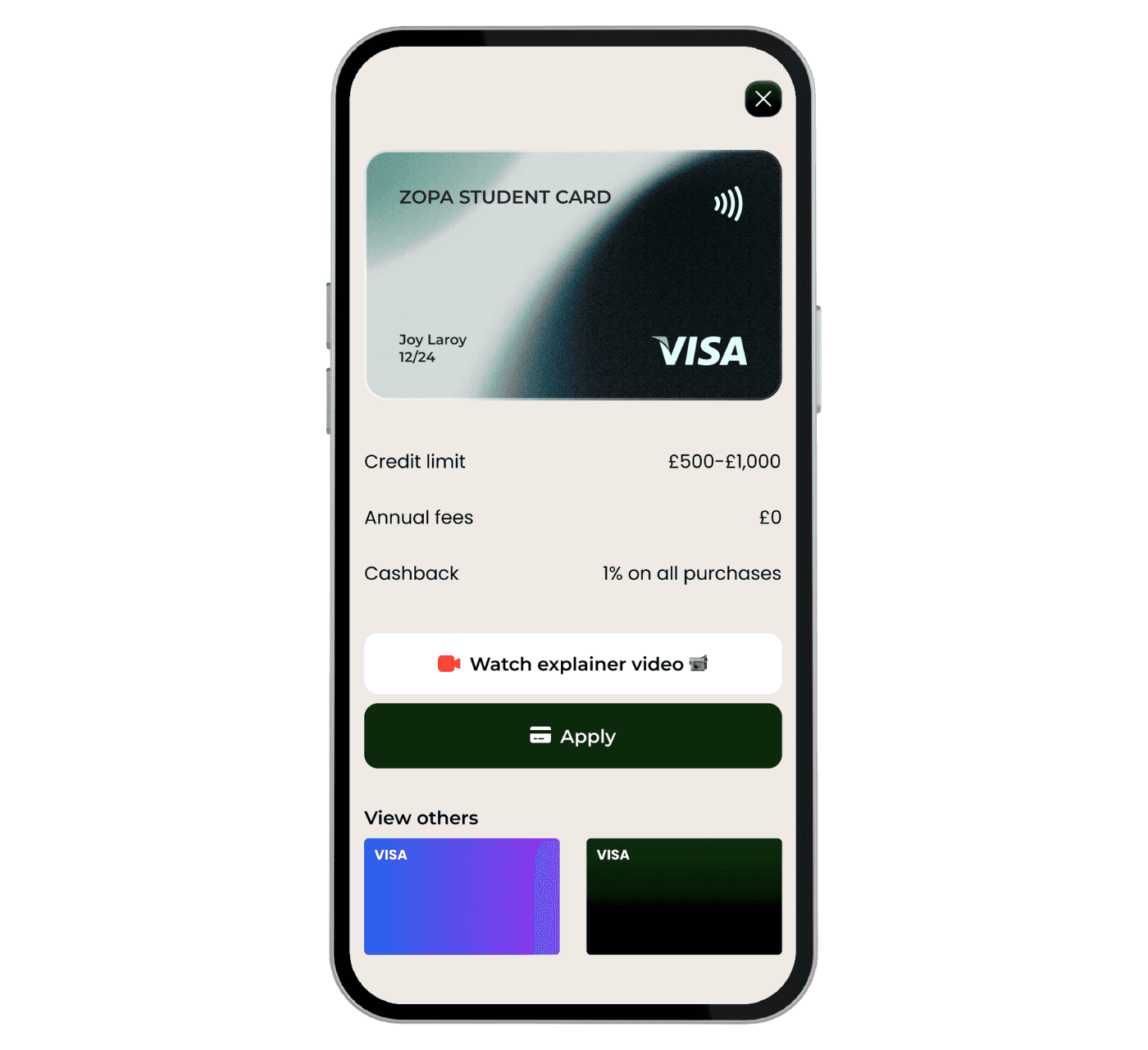

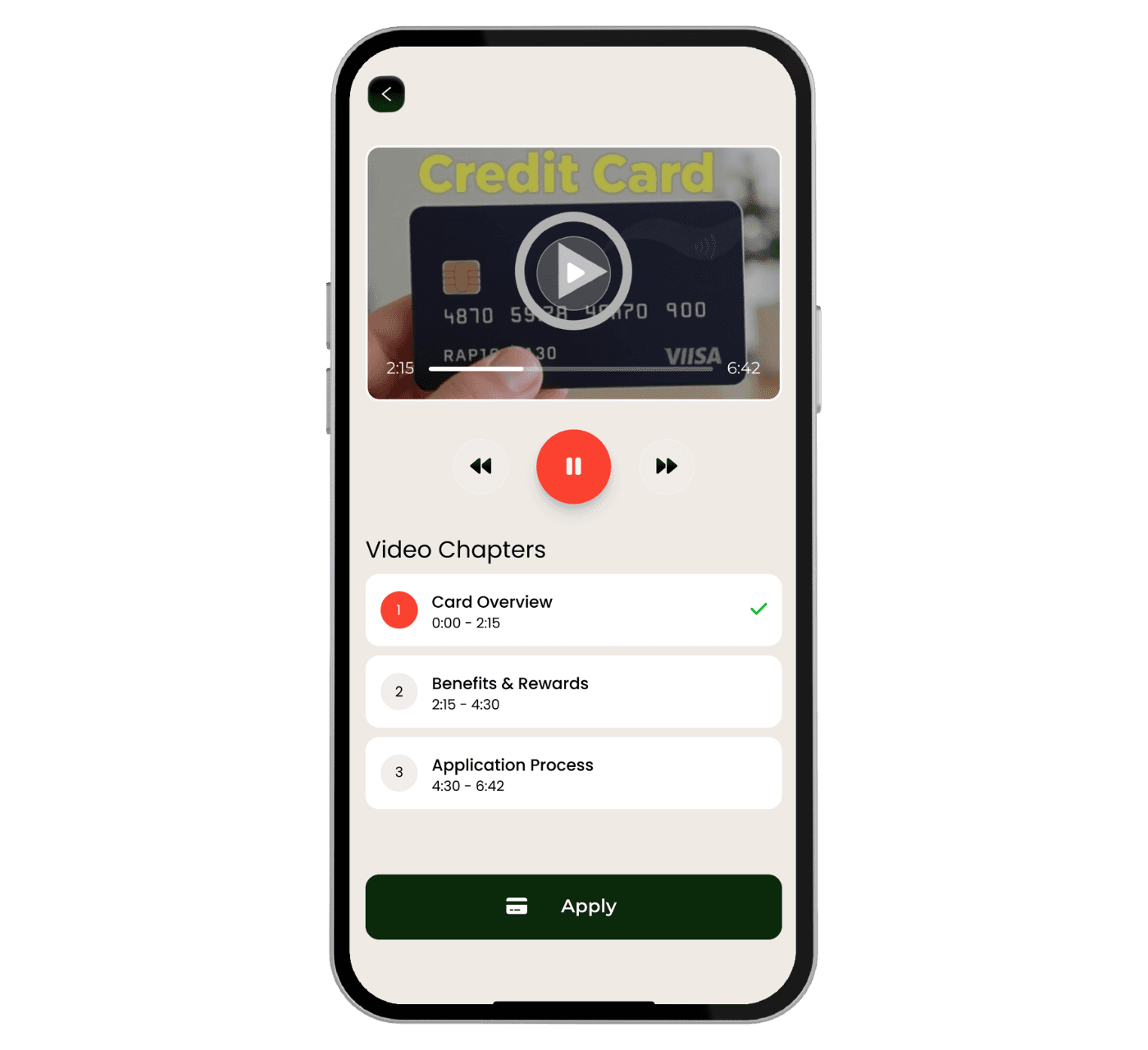

Cards Discovery & Video Explainers

Users can browse and filter beginner-friendly credit cards by category such as student or builder cards. Each card includes an explainer video, helping users understand which is best for them. This format mirrors familiar social media content, making financial information easier to digest and act on.

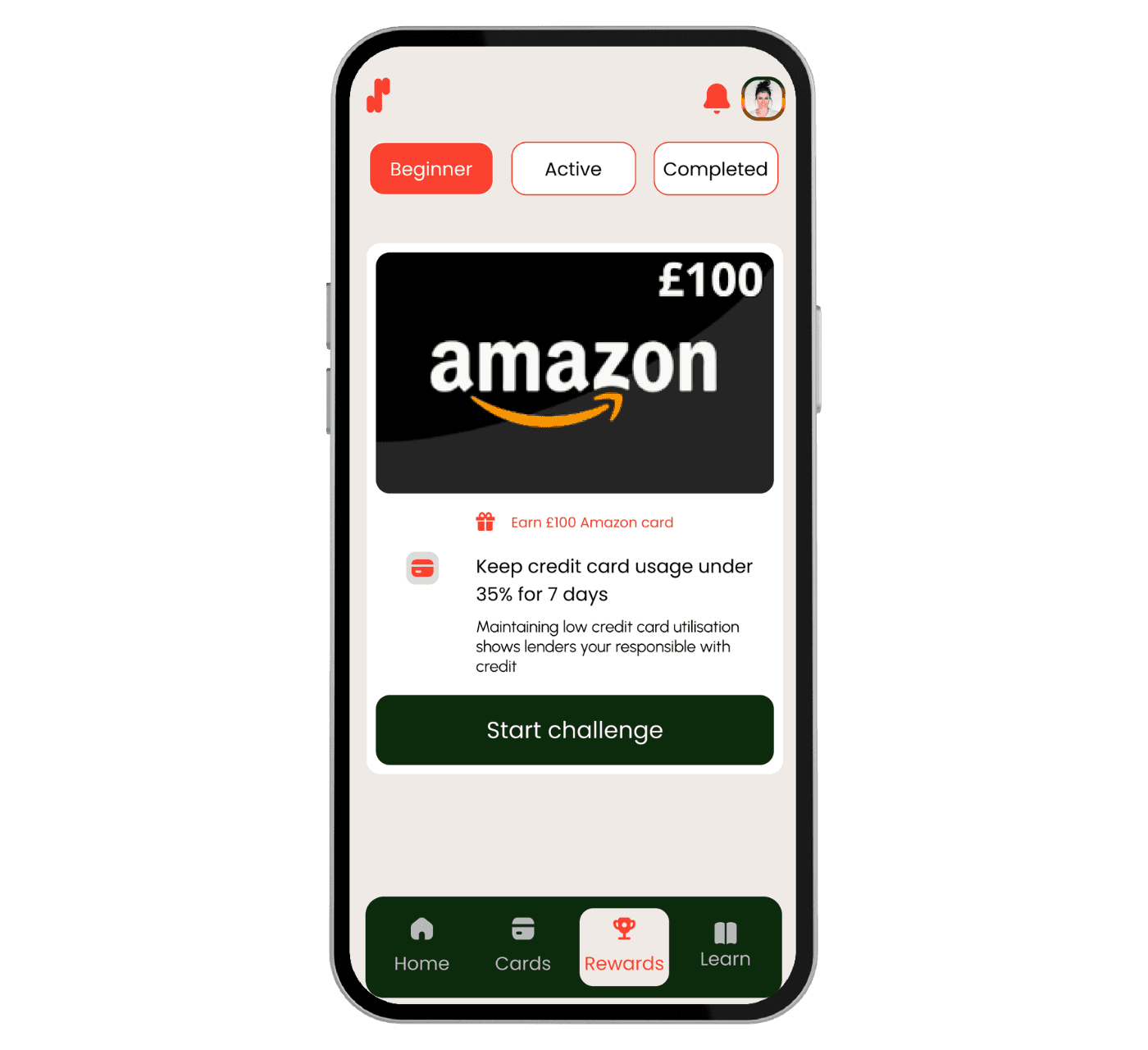

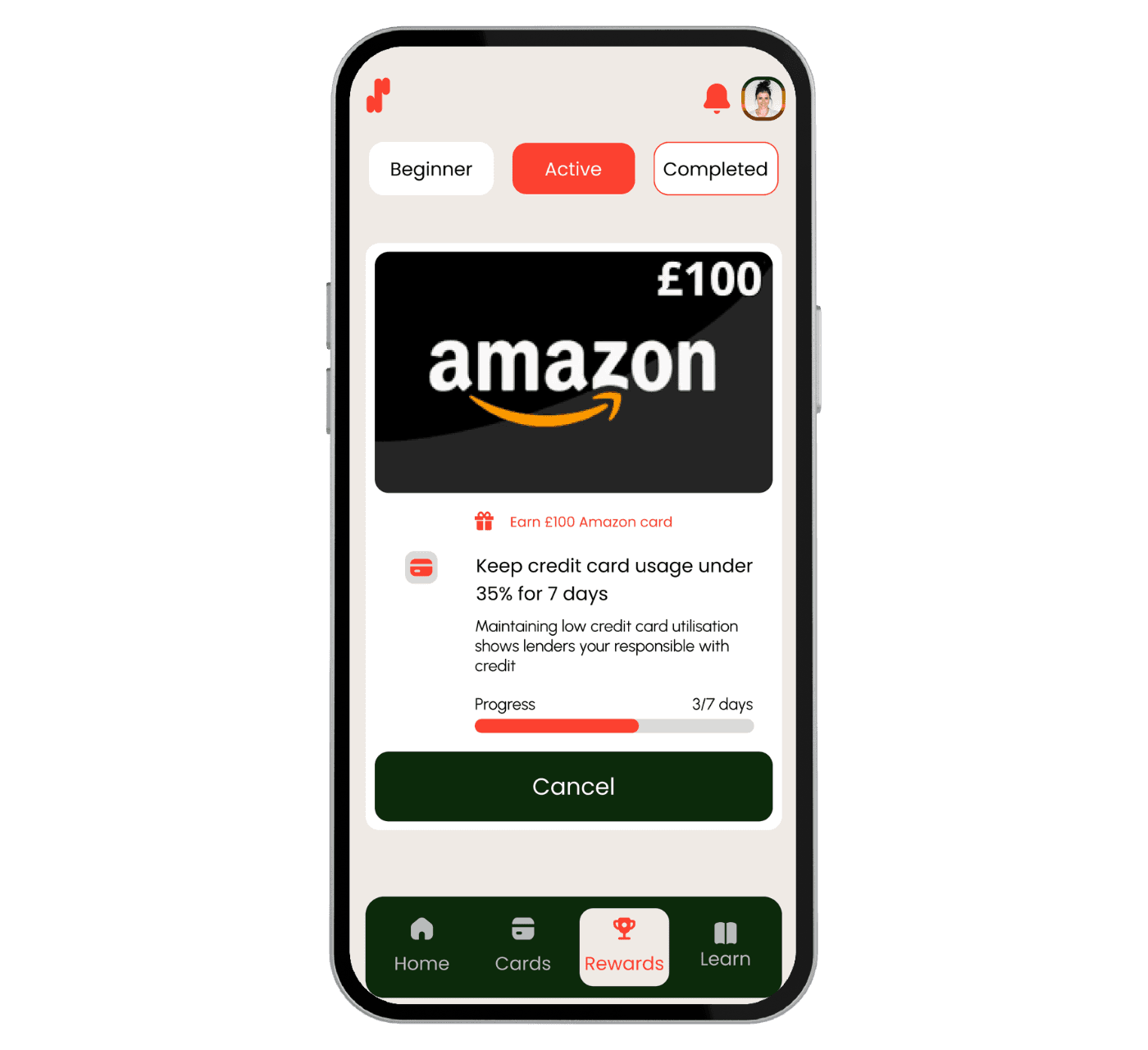

Rewards & Challenges

To help users build credit safely, the app includes gamified challenges (e.g. “Keep usage under 35% for 7 days”) that reward positive habits with real-world incentives like Amazon gift cards. Challenges are personalised based on user behavior and score level, reinforcing discipline with purpose.

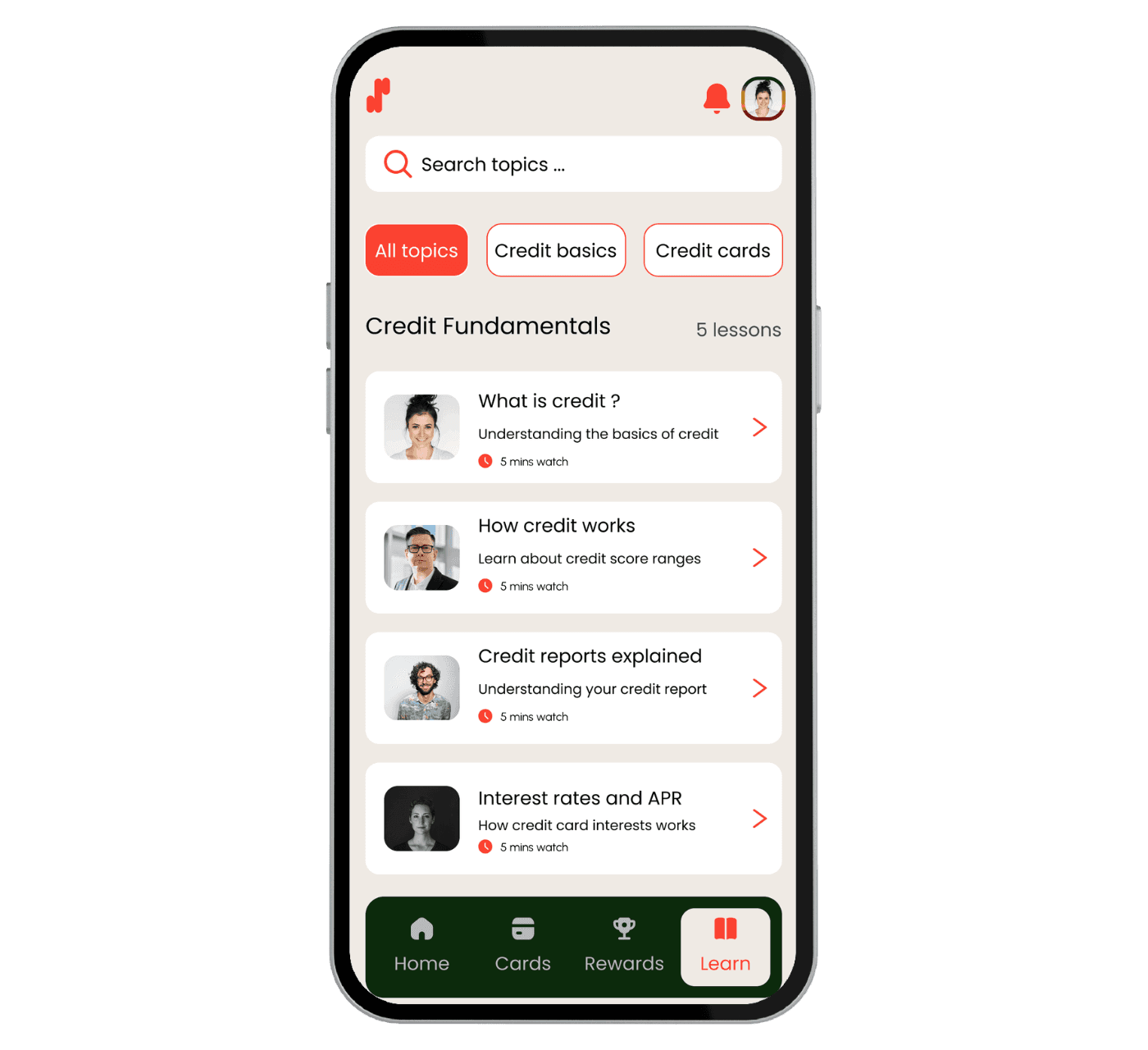

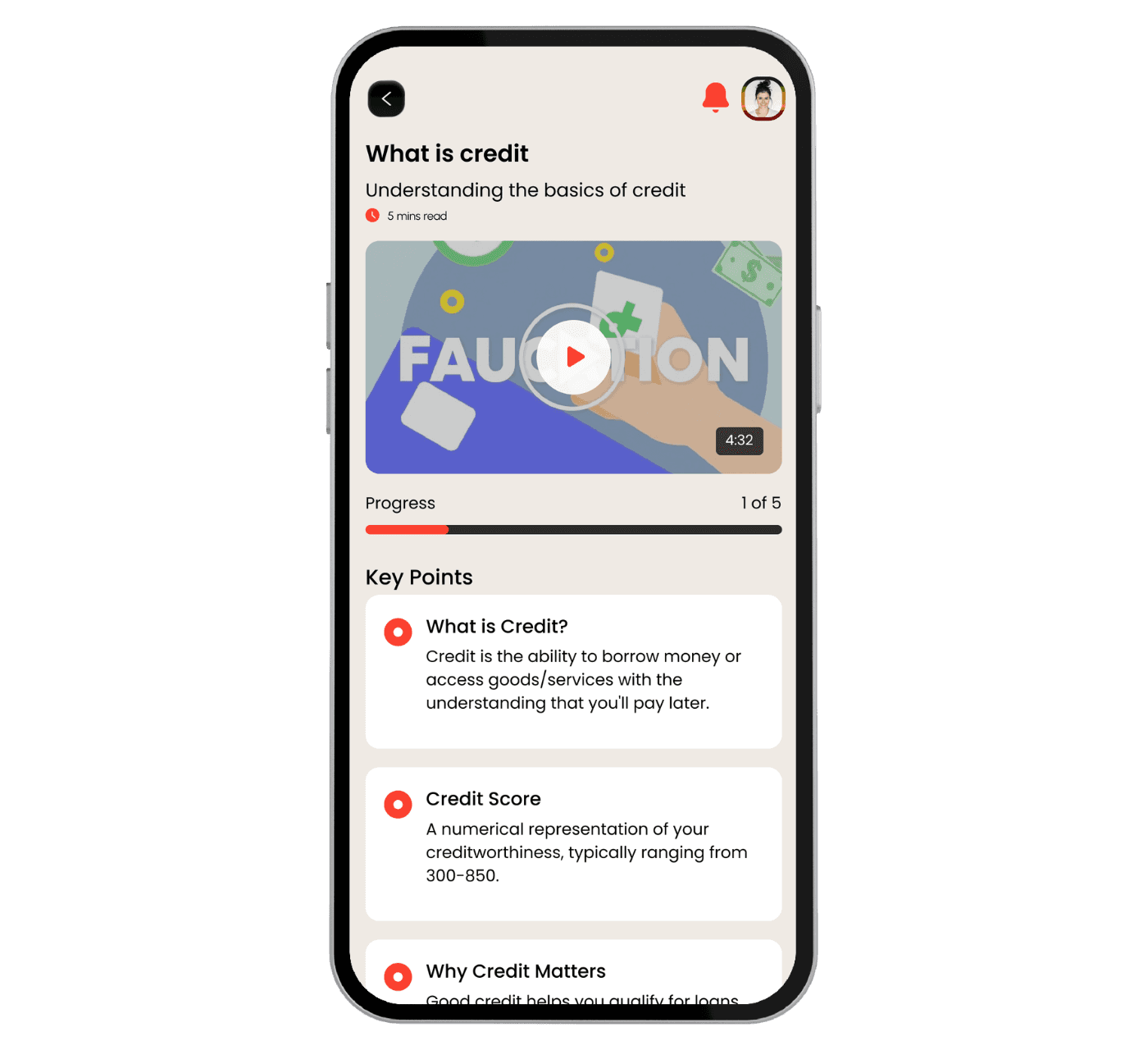

Education Hub

Designed as a quick-access learning center, the hub offers credit tips, terminology explainers, and behavior-based guidance. Users can quickly learn how to use credit responsibly without jargon, helping build confidence and knowledge in moments of need.

Key Results

Early user testing showed strong interest, with 1,300% incresase in waitlist signups since showcasing the prototype.

A 2.5x increase in feedback rate from angel investors, driving more conversations and funding opportunities.